Revenue Reserve

Murray International

Overview

The objective of this trust is to achieve a total return greater than its benchmark by investing predominantly in equities worldwide. Within this objective, the manager will seek to increase the company’s revenues in order to maintain an above average dividend yield. The Company’s assets are invested in a diversified portfolio of international equities and fixed income securities spread across a range of industries and economies. The Company's customised benchmark is a composite Index made up as to 40 per cent of the FTSE World-UK Index and 60 per cent of the FTSE World ex-UK Index. The fund charges a total expense ratio of 0.64% per year.

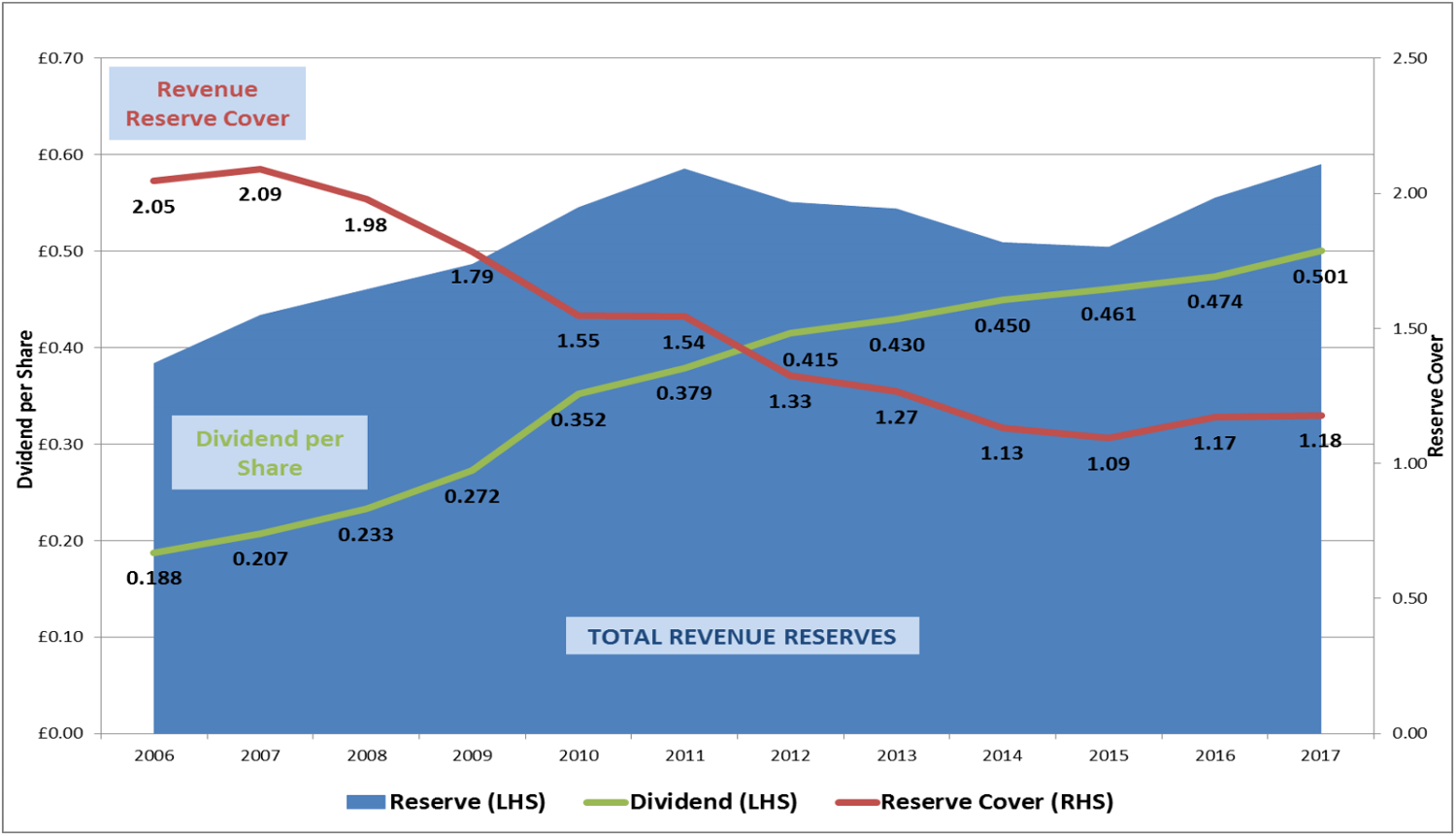

Reserves, Dividends & Cover

The dividends per share have significantly increased over the last 10 years showing strong growth above inflation. The total increase was 166.79% (9.33% annualized). The revenue reserves have not been increased at the same rate as the dividends with an increase of 53.65% (3.98% annualized), which means that the reserve as a percentage of the dividends has reduced over the period. The reserve cover started at a level of 2.05 years in 2006 and ended with 1.18 years in 2017. Over the period, the company has paid out cash reserves to maintain the strong dividend increases, which has reduced the revenue reserve. The 10 year change in revenue reserves is 6.32% p.a. versus RPI at 1.92% p.a.